Watch The Penny Bitcoin Video Series

Welcome Aboard!

Hey, everyone. I'm Louis Basenese. I want to welcome you to The Crypto Alert. I'm the Director of Cryptocurrencies here at Agora Financial.

My career has spanned from Morgan Stanley to Silicon Valley, and in that time, after helping direct and manage over a billion dollars to seeing countless new technologies launch into the market, I can confidently tell you that cryptocurrencies are just hitting the tipping point.

It's not too late. It is absolutely the perfect time to be getting involved.

I would tell you that at the same time, cryptocurrencies are at the most volatile or developmental phase of their growth. But the key is the market's biggest gains live right here.

It's like investing in a development stage company that's yet to be discovered.

There aren't necessarily many fundamentals, but that is the perfect time to invest.

That is when the biggest gains are realized as these new discoveries and new technologies and the potential for them are unlocked and realized by the public.

The fundamentals do matter, but they will come into play later on.

But what matters most for us right now is that you don't have one expert, but you have three working on your behalf to time this market.

I'm partnering with a currency expert in Martin Hutchinson, and I have a research staff led by Jonathan Rodriguez.

I can assure you that you'll be well-informed and will be kept well up-to-date on all that's going on in the cryptocurrency markets.

In fact, getting into the real specifics, I want you to know that you can expect at least one alert every week, and then in addition to that, we'll make buy and sell alerts as needed.

So as the markets move quickly, we will send out those alerts immediately.

But here's the best part…

And really the thing I want to focus on today.

In the weeks ahead, some 260,000 businesses will begin accepting some form of alternative currency as payment for goods and services.

And that number will only grow in the years to come.

That means “penny” cryptocurrencies — like the ones I’ll be recommending here at The Crypto Alert — have the same potential that Bitcoin did when in 2010, it was trading for less than one cent.

A mere $20 stake in Bitcoin then is worth $15.1 million today.

We should expect to experience similarly high-octane opportunities.

There are now over 900 cryptocurrencies exchanging hands on the open markets.

The vast majority trade for just pennies, just like Bitcoin did back seven years ago.

So strap yourself in — because the next cohort of cryptocurrencies is about to rocket into the stratosphere.

I’ve pinpointed three that you should consider buying right now.

Just refer to the alert in your inbox for details.

In video #2, I’ll flesh out the opportunity now sitting before you a bit more.

This is Louis Basenese, signing off.

The Cryptocurrency Eruption.

Hey, everyone. Louis Basenese here, Director of Cryptocurrencies at Agora Financial.

I want to welcome you back, and tell you what we're going to do in this next video.

I'm going to begin to unlock the world in which you'll soon be living.

So let's start with the basics…

What is a cryptocurrency?

A cryptocurrency is a digital currency that operates outside of any government control.

That means these currencies cannot be manipulated by central banks like our own Federal Reserve or other central banks around the world.

Until now, every currency transaction in the history of the world has taken place via a financial intermediary, like a bank.

The bank would verify the transaction, theoretically adding a level of trust.

But we’ve long lost trust in banks.

So now cryptocurrencies are completely revolutionizing the old system — cutting out the middleman entirely.

This new type of digital transaction is made peer-to-peer, without a middleman.

And it’s all thanks to an invention called the “blockchain.”

Now, let me state for the record…

Knowledge of the blockchain is NOT a prerequisite to trading my cryptocurrency recommendations.

But it can’t hurt to understand the process happening behind the scenes, right?

So here goes…

The blockchain is a decentralized database that records every currency transaction.

Put another way…

Blockchain is essentially the trusted backbone of all cryptocurrency transactions.

I’ll expand on the importance of the blockchain in my next video.

But for now, just know this…

Every 10 minutes, the blockchain verifies and stores all transactions (exchanges of value) conducted within that block of time.

The newest 10-minute block is linked to the preceding 10-minute block, thereby creating a chain.

Each new block must share the same digital “signature” as the preceding block to be valid.

When the current block is validated, all transactions are permanently time-stamped.

The result is a tamper-proof, public, digital ledger that represents the consensus of every transaction that has ever occurred.

So why can’t the blockchain ever get hacked?

Great question.

The answer is what makes the technology so revolutionary.

The fact that blockchain is a public ledger — stored on every computer that partakes in the network — is what makes it so immutable.

A central hub that manages everything doesn’t exist!

Therefore, the blockchain has no single point of failure from which records can be hacked or tampered.

So the true beauty of the blockchain is that it’s backed up by every single participant in the network.

Think of it as a public ledger engraved upon a digital, un-erodible rock.

Heck, the world’s most powerful supercomputers, working every second of every day, would need over 10,000 years to breach the blockchain’s inherent security.

Experts estimate that it would take a billion dollars to launch an attack sophisticated enough to even try to crack it.

Okay, that’s it for the basics.

In video #3, I’ll reveal why blockchain is the real reason all of this madness is happening.

Blockchain: The Biggest Tremor of All.

Louis Basenese here, Director of Cryptocurrencies at Agora Financial. I want to welcome you back again.

In this next video, I’m going to up the ante on blockchain.

That is, because after we’ve made our fortunes on cryptocurrencies, we could do it again investing alongside tiny blockchain companies.

Now, I know what you must be thinking…

How can a digital ledger — one that is entirely public and shared by everyone — individually carry such weight?

The answer is as easy as A-B-C…

A.) If every business transaction that will ever occur, into infinity, can be digitally archived, and…

B.) If this digital archive is totally immutable, meaning it can never be corrupted or hacked, then…

C.) Most white-collar jobs, banks, insurance companies, stock exchanges, accounting and billing systems, healthcare records, and government agencies can be replaced with software.

Have you ever been cheated by an insurance company?

Has your electricity bill ever been too high?

Has your credit-card statement ever been wrong?

Has your checking account balance ever been incorrect?

Has your Medicare reimbursement check ever been too low?

Well, imagine this…

Blockchain technology will ultimately advance beyond cryptocurrencies into every industry.

Once that happens…

You’ll never have to trust a third party to facilitate your business affairs again!

Every above-listed transaction will soon be verified by the blockchain, which means you can't get fleeced.

In the event that an unscrupulous counterparty tries to cheat you — every transaction is easily accessible for the world to see.

So cheats like Madoff will be outed as such in a split second.

Even two parties that historically don’t trust each other — like, say… the Hatfields and McCoys — can routinely conduct business together.

That is, because a public ledger means we don’t keep our own books.

Rather, we share a common set of books that represents the unquestionable, unequivocal, incontestable, un-hackable, absolute truth.

Right now…

The pure play into blockchain is through strategic investment in cryptocurrencies, and that is our sole focus.

BUT…

I won’t hesitate to recommend tiny companies, too. Occasionally.

As a Goldman Sachs report states…

“The blockchain can change everything. From banking and payments… to notaries… to voting systems… to vehicle registrations… to wire fees… to gun checks… to academic records… to trade settlement… to cataloguing ownership of works of art — a shared ledger has the potential to make interactions quicker, less-expensive and safer.”

It’s already happening...

According to Business Insider, nearly every global bank is testing the blockchain in some capacity.

The NASDAQ just reported a “successful” trial using the blockchain to conduct proxy voting among shareholders.

IBM just launched a new carbon-trading exchange underpinned by the blockchain.

Wal-Mart is testing the blockchain to run its massive supply chain.

Amazon is testing the blockchain to manage its cloud.

Brand-new ride-sharing platforms (Lazooz and ArcadeCity) have arrived to challenge Uber with more competitive pricing models — using the blockchain, of course.

OpenBazaar has quickly risen to challenge eBay — by using the blockchain to cut the “middleman fees” associated with online auctions.

Not even the cannabis craze is safe from disruption…

Growers are using the blockchain to register and track thousands of different strains of pot — strains like Pineapple Express, Blue Dream and Granddaddy Purp.

Next up for the blockchain is a slew of civic disruptions, including…

>> Ending identity theft by creating an immutable digital identity for everyone.

>> Ending corporate tax loopholes.

>> Ending election/voter fraud.

>> Ending the misallocation of charitable donations.

>> Managing entitlement benefits — like Social Security, Obamacare, Medicare, even Medicaid.

As you can imagine, there’s a race among banks to stake their claim.

356 blockchain patents are in play, with applications having been filed by virtually every big bank.

And a key patent was just issued to Goldman Sachs.

So just keep in mind that there are many ways we’ll be looking to profit on blockchain beyond cryptocurrencies.

But that’s down the road a bit.

Right now, we’re all in on cryptos!

In video #4, I’ll help you set up your crypto wallet.

This is Louis Basenese, signing off.

Preparing to Trade Cryptocurrencies.

Hi there.

Louis Basenese here — Director of Cryptocurrencies here at Agora Financial.

I want to welcome you back and again thank you for becoming a member of The Crypto Alert.

Now, before I begin this next video, I need to make a key point…

It’s an important point, too.

While you’re waiting for my courier to arrive with your starter package, which includes…

>> a debit card loaded with Ethereum, and…

>> a Trezor wallet for extra security…

This video will help you get started without either of those two things.

Yup — you’ll be able to start buying and selling my recommendations today, if you so desire.

Or, you can wait for the courier to arrive — it’s up to you.

I’ll be releasing new recommendations quite regularly, which means you never have to worry about missing out.

Okay, so again…

This video assumes that you want to start trading today, even though my courier hasn’t arrived yet.

Cool?

So here goes…

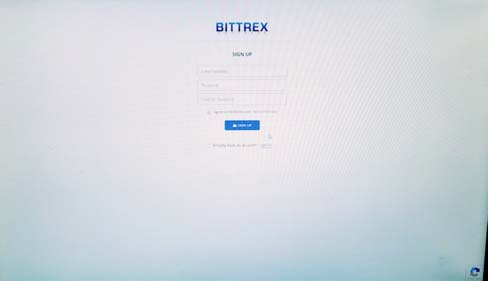

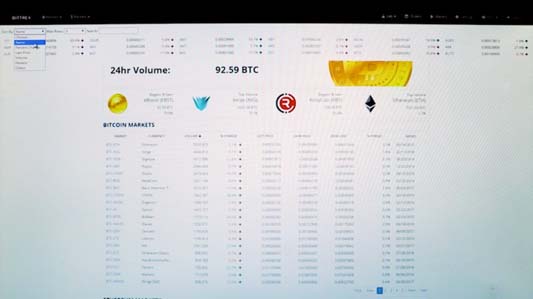

Please open your browser and navigate to www.Bittrex.com, where you’ll need to open an account.

Okay, now we’re at Bittrex’s homepage.

Bittrex is the exchange where we’ll buy/sell cryptocurrencies.

The first thing you’ll need to do is sign up for a new account.

To do that, click the Login tab in the upper right corner of the screen.

Then click, “sign up.”

Okay, the process is very straightforward — just like you’d experience when signing up for any new account-based web service.

That is, with only one caveat…

As you’re going through the very simple setup process, I highly recommend activating the two-step verification method.

That will require you to download the Google Authenticator app on your smartphone, which will generate an additional randomly generated six-digit code to enter before you can log in.

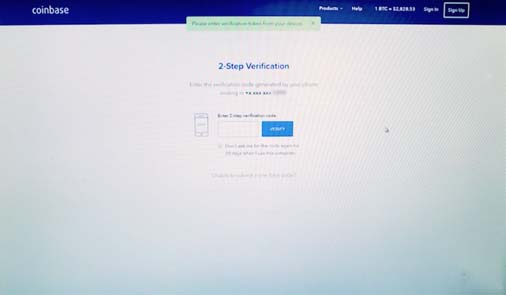

Okay, since I already have a Bittrex account, I’m going to click “sign in,” and then enter my username and password.

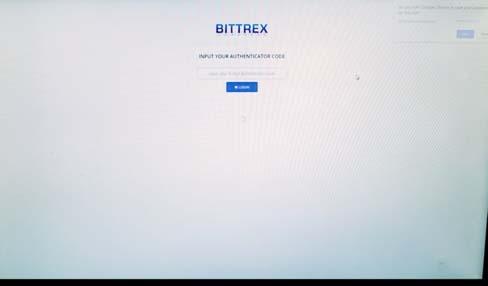

Now, you’ll notice I just got prompted to “input my authenticator code.”

This is where I’ll grab my smartphone, open the Google Authenticator app, and enter the code it gives me.

Again, I highly recommend this extra step for security purposes.

It’s simple to do, and gives you a worthwhile extra level of security.

Just enter the random-generated code, and log in.

Congrats, you’re one step closer to buying your first cryptocurrency.

Now you’re going to need some money to start your buying campaign.

But you can’t fund an account directly through an exchange like Bittrex.

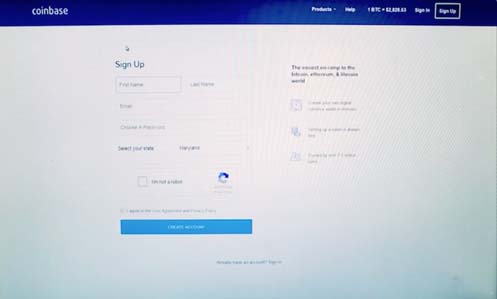

So to fund an account, let’s navigate over to www.Coinbase.com.

Okay, now we’re at the Coinbase homepage, where we’ll fund an account.

So go ahead and click on the “sign up” link in the upper right corner of the page.

Next, you’ll go through many of the same simple prompts that you did on the Bittrex homepage.

It’s very self-explanatory.

Oh, and again, I highly recommend activating the same two-step verification method using Google Authenticator.

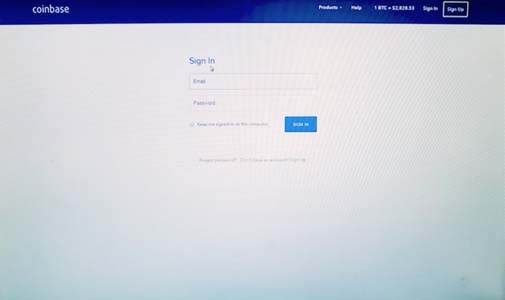

Okay, since I already have a Coinbase account, I’m going to click “sign in,” and then enter my username and password.

Now, you’ll notice I just got prompted to “input my authenticator code.”

Once again, I’ll grab my smartphone, open the Google Authenticator app, and enter the code it gives me.

Again, I highly recommend this extra step for security purposes.

It’s simple to do, and gives you a nice extra level of security.

Just enter the random-generated code, and log in.

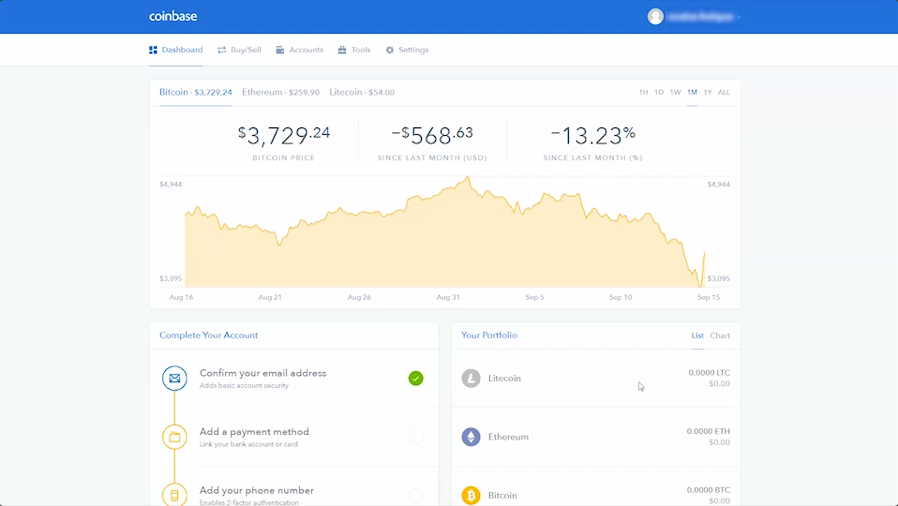

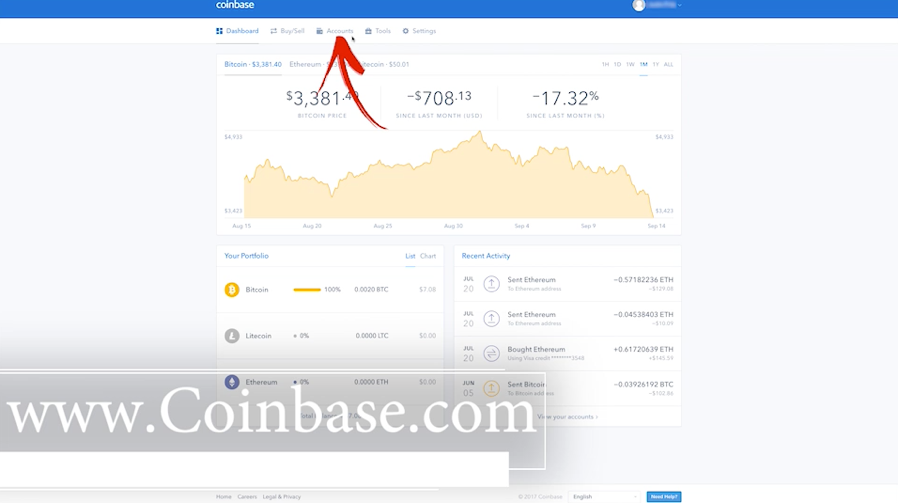

Okay, logging in parks you onto Coinbase’s “dashboard” page.

From here, you can see the current price of Bitcoin, and your current account balance…

Which for you, right now, is zero…

So let’s change that by adding funds.

Now, what I’m about to tell you is important…

So please listen up.

The easiest way to buy any cryptocurrency on Earth is to start with Bitcoin.

Now, I know... I know…

Bitcoin is trading north of $2,000!

But you don’t have to buy a full Bitcoin.

You can buy any dollar amount that you want.

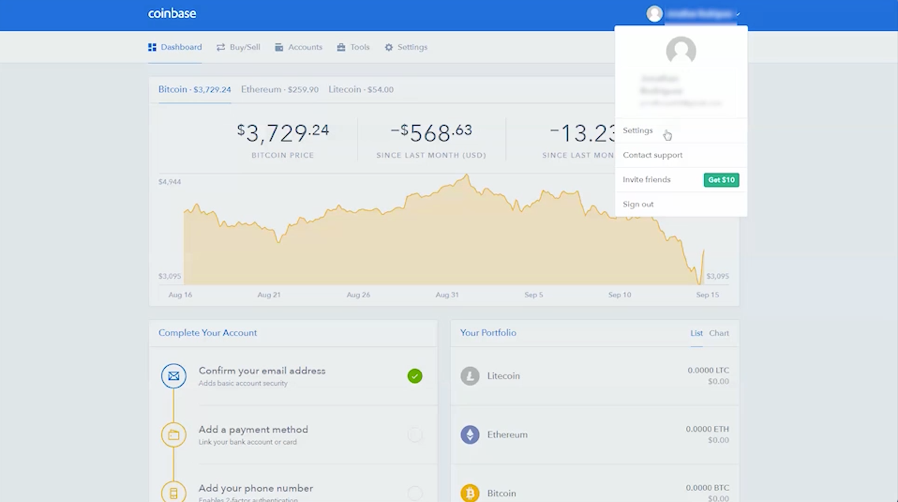

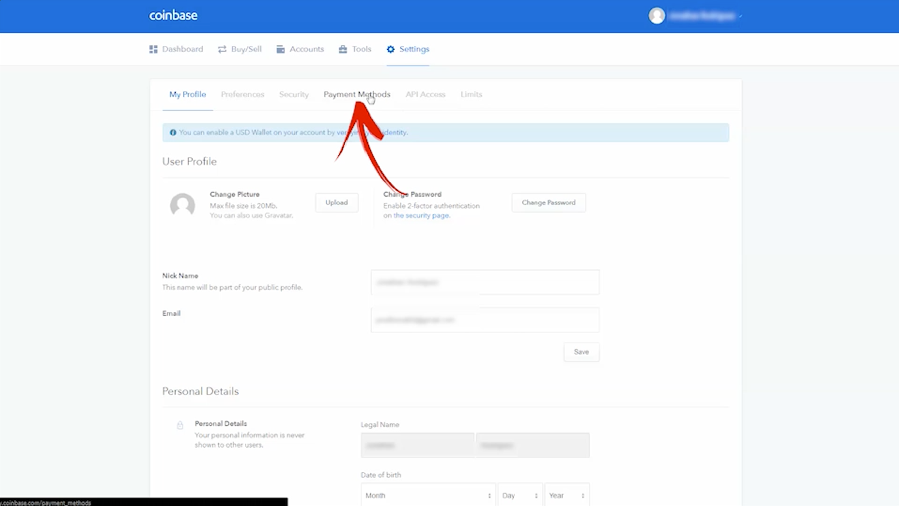

So to fund your new account with Bitcoin, click on your name in the upper right corner of the screen.

When the drop-down menu appears, click “settings.”

And then, near the middle of the screen, click “payment methods.”

Since you’re a newbie, click on “add payment method.”

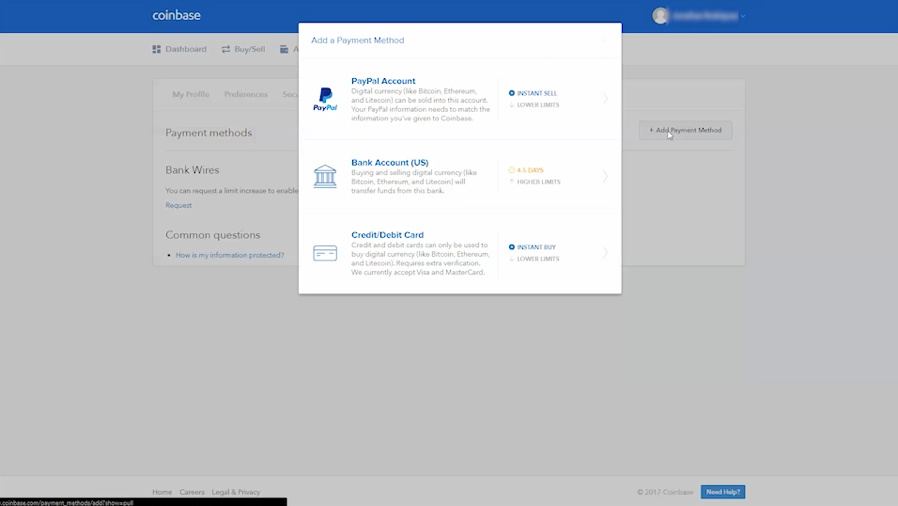

The next screen gives you three choices upon which to fund your account…

PayPal, your bank account, or Visa/Mastercard.

I happen to like the immediate gratification of a credit card, however…

Please note that there will be a small processing fee if you go the credit-card route.

For those of you going with a credit card, click “instant buy” and input your data into the required fields.

What you’re doing is buying Bitcoin with dollars.

Okay, congrats!

Now you own some Bitcoin.

Okay, good.

Now we need to move those funds over to the Bittrex exchange to start buying.

So please navigate back to your Bittrex account.

If you logged out, you’ll need to log back in.

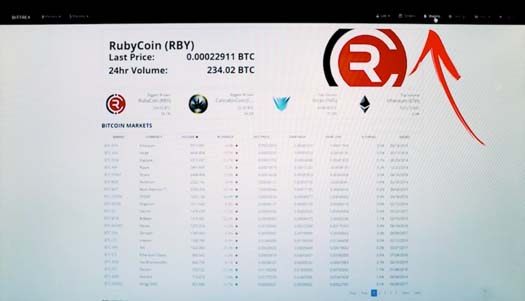

Okay, so now we’re back inside our Bittrex account, which is the exchange we’ve chosen to buy and sell our cryptocurrencies.

What we’re going to do now is move the Bitcoin that we presently have in our Coinbase account over to Bittrex.

Again, Bitcoin is the launch-point for our buying campaigns.

To do that, click the “wallets” tab at the top.

Next, click on the “plus sign” next to Bitcoin.

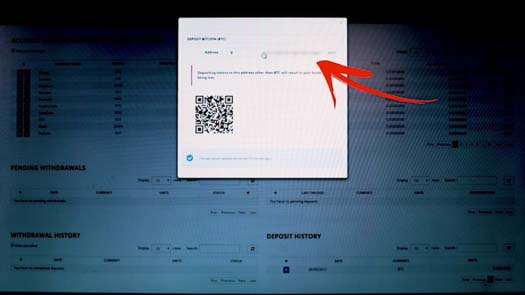

Now, copy that address into memory — that’s the address we’ll send our Bitcoins in our Coinbase account to. (It may take a couple minutes for the address to populate.)

So double-click the address to highlight it.

Right click on your mouse, and click “copy.”

There, now it’s temporarily stored in memory.

Next, go back to your Coinbase account.

And here we are — back again at Coinbase.

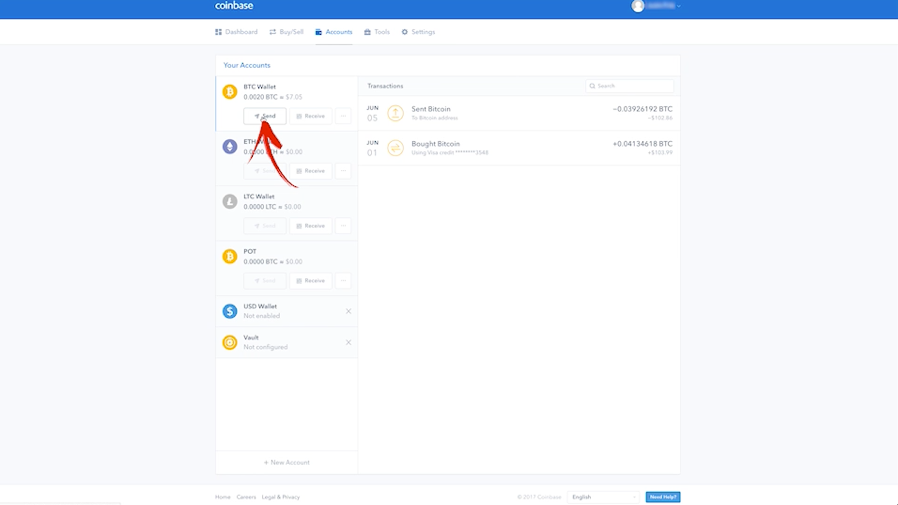

Click on the “Accounts” tab at the top of the nav bar.

Once there, click “Send” under your Bitcoin wallet.

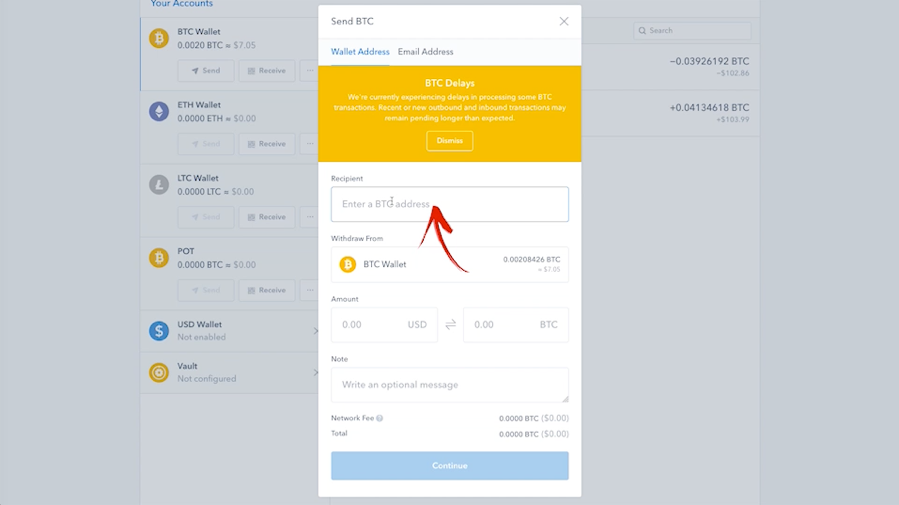

Ok, now right click in the text box and then click “paste.”

What you’re doing is pasting in the Bittrex address — so this is where your Bitcoins are about to land, which is what we want.

Next, enter the amount of funds that you would like to transfer.

You can enter funds in U.S. dollars, or in Bitcoin. As you can see, there is a box for both.

Notice the small fee that Coinbase will charge for the transfer.

The total amount is listed below the fee.

Now all you have to do is click “Continue.”

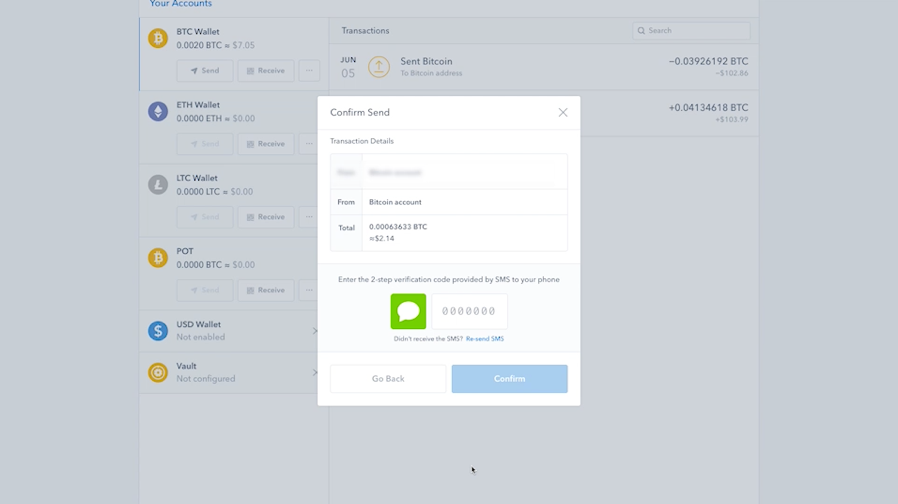

Once you click “Continue,” you’ll be prompted to confirm your decision.

Piece of cake.

Okay, now it’s back to Bittrex to begin our buying.

We’re so close now!

When you navigate back to Bittrex, make sure you’re still on the “wallets” page.

If you navigated away, just click “wallets” at the top of the screen.

Okay, the blockchain updates every ten to 15 minutes, so if you don’t see the transferred funds immediately, that’s perfectly normal.

And when the funds do appear, you’ll see them in the “pending” column.

Then, a few minutes later, you’ll notice that the funds have moved into the “available balance” column.

Once the funds are safely in the “available balance” column, it’s a signal that you can place a live-trade.

So let’s do it!

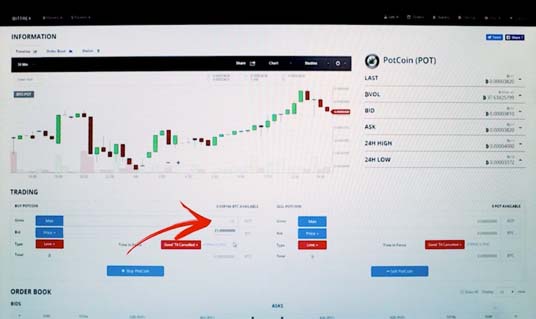

For our example, let’s say we’re interested in buying potcoin.

I’m bullish on potcoin, for the record — but it’s not an official recommendation here at The Crypto Alert.

Okay, here goes…

First, navigate back to the main page by clicking the Bittrex icon in the upper left corner of the screen.

Cool.

Now, we’ll run a query on potcoin.

To do that, click the “markets” tabs — either one!

One tab shows you the price in Bitcoin, the other will show the price in dollar terms.

I’ll use the one priced in Bitcoins.

Once I click, a drop-down box appears.

In the first field, choose to sort by “name.”

And then in the search field, type in the ticker for the coin you want to buy.

The ticker for potcoin is: POT.

And then simply select it when you see it appear.

Okay, good.

Now you can see the real-time prices for potcoin, along with a chart.

So now we’re going to buy potcoin.

Let’s buy 15 coins.

So type 15 into the “units” field.

Now, for price — we want to purchase potcoin as close to the bid price as possible.

So in the “price” drop-down menu, select “bid.”

Go ahead and try placing an order at-the-bid — just to see if gets filled.

If not, simply ratchet up your offer ever so slightly.

Patience is the key when buying.

If you chase prices near the “ask price,” you’re likely overpaying a bit.

Now, you’ll notice two default settings for your order —

“Limit order” and “good until cancelled” —

Both of those settings are perfect. So run with them.

In the bottom field, it will tell you how many Bitcoins it will take to fill your order — again, with Bitcoin trading above $2,000, we’re talking fractions here.

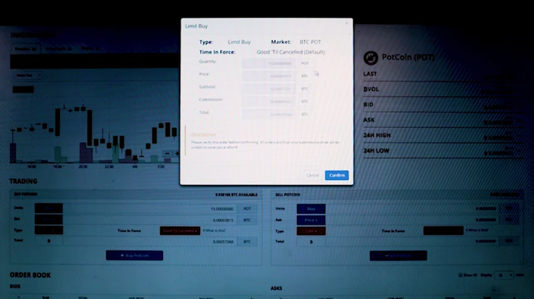

When you’re locked and loaded, click “buy potcoin.”

Then, you’ll get one more prompt, which gives you a chance to review your order very closely.

In our example, we have an order ready for 15 potcoins.

At a price just above the bid.

You’ll notice a modest commission — just like when you’re buying a stock.

And then your total appears at the bottom — all priced in Bitcoin.

If you’re satisfied, click “confirm.”

Once you click “confirm,” your order will be placed.

When it gets filled — in this theoretical example — you’d be the proud new owner of an exploding cryptocurrency.

So,congrats!

Okay, in the next video, I’ll prepare you for the arrival of your Ethereum card.

This is Louis Basenese, signing off.

Unlocking Your Ether Card.

Hi there.

Louis Basenese here — Director of Cryptocurrencies at Agora Financial.

Welcome back.

If you’re watching this video, it means my courier must’ve arrived with your Ethereum debit card.

If I’m wrong about this, please loop back to the previous video, and follow the steps I describe there.

That way, you can actively trade my recommendations without the Ethereum card.

Still with me?

Cool.

Okay…

Grab your Ethereum card, which may look a bit different from mine.

Flip it over.

And scratch off your “private key.”

It’s just like a scratch off.

Scratching will reveal a series of 12 words.

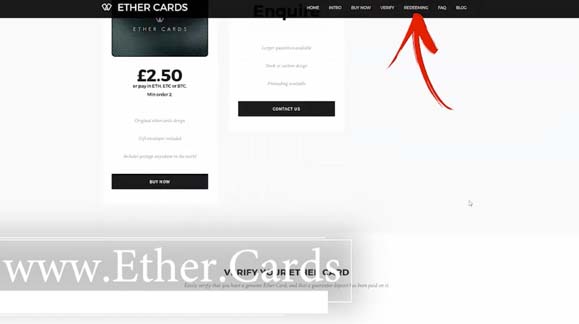

Okay, now open your web browser and navigate to www.ether.cards

Click on “Redeeming” in the top navigation bar.

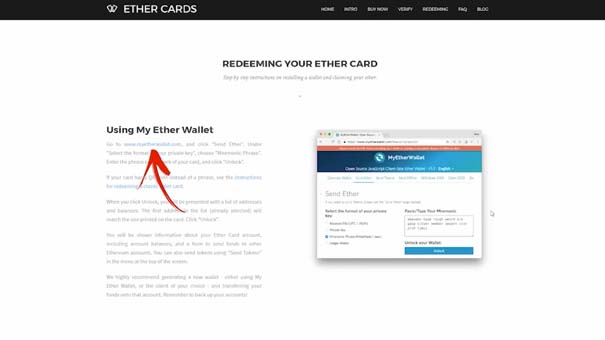

Then click on www.myetherwallet.com.

The link is located under the header “Using my Ether Wallet.”

Okay, cool.

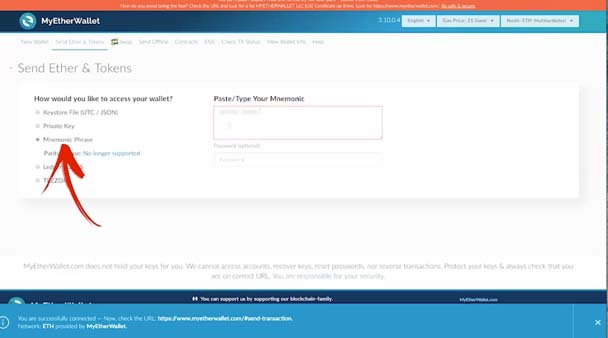

Once you’re there, select “Mnemonic Phrase.”

Now, type the 12 words under the scratch-off into the box.

Progress one column at a time, using all lowercase, and make sure to include a space in between each word.

Good.

Now click “Unlock.”

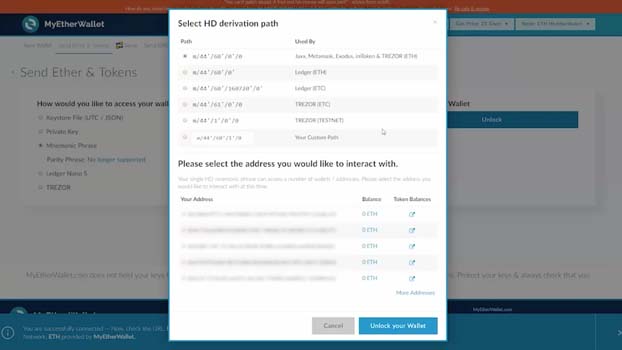

Next, select the address that has your balance in it, and click “Unlock Your Wallet.”

The only thing left to do is something I covered in the previous video.

Please listen closely, as this is important…

You need to send the Ethereum balance — the one you just unlocked — to Bittrex.

Bittrex is the exchange where you’ll be buying and selling cryptocurrencies.

I’m assuming that you’ve completed the Bittrex set up from my previous video.

If so, you have a Bittrex account ready to go.

If you haven’t completed this step, please loop back to the previous video and pay specific attention to the Bittrex instructions.

There’s no way to avoid setting up a Bittrex account.

Still with me?

Cool.

Let’s pick up where we just left off….

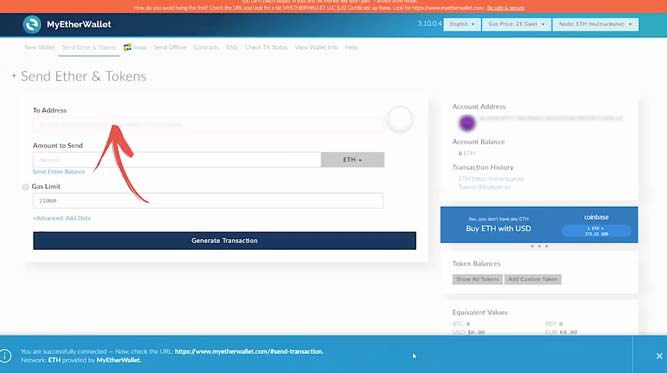

Now, grab your address from Bittrex, and paste it into the “To Address” field.

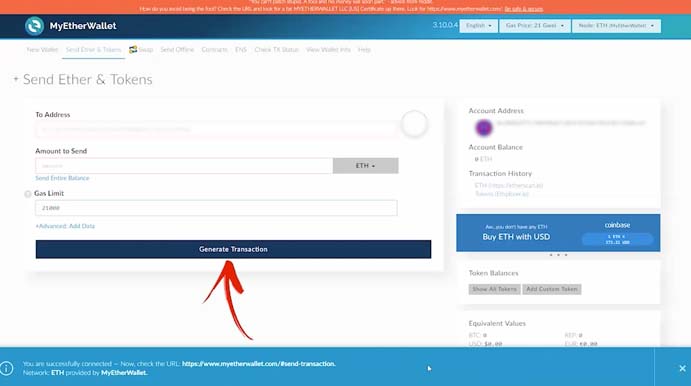

Type in the amount you want to send to Bittrex, and then click “generate transaction.”

As for the “gas price” field, just use whatever amount is in there.

The “gas price” is a small fee to make the transfer.

Okay, cool.

If you did everything correctly, you should see the balance hit your Bittrex account in a few minutes.

In the next video, I’ll show you how to set up your Trezor device.

This is Louis Basenese, signing off.

Setting Up Your Trezor Device.

Hi there.

Louis Basenese here — Director of Cryptocurrencies here at Agora Financial.

Welcome back.

Okay, in this next video, we’re going to set up your Trezor Wallet.

First, I’d like to describe exactly how the Trezor Wallet can help you.

It’s worth noting that the name itself — the fact that Trezor calls its device a “Wallet” — is a bit of a misnomer.

I’d say it’s more of a physical padlock for your digital wallet.

None of your coins will ever be physically stored inside the Trezor.

Rather, the Trezor makes it virtually impossible for a hacker to get inside your digital wallet.

It provides an extra level of security, as you’re about to see.

Yet the Trezor Wallet isn’t required to trade cryptocurrencies.

I’ll repeat, the Trezor Wallet isn’t something you MUST have to trade.

Me, personally? I feel comfortable and safe enough using Google’s two-step Authenticator, so I don’t use the Trezor Wallet.

I follow the simple steps that I outlined in video #4 — and I follow them to the letter of the law.

But that’s just my personal preference.

Some folks like the idea of a physical padlock.

If you’re such a person, the Trezor Wallet is definitely for you.

I just want to stress that it isn’t required, and it does mean going through an extra set-up process.

Still with me?

Okay, please open a web browser and navigate to www.trezor.io

Weird, right?

There’s no dot-com.

Still, go ahead type www.Trezor.io into your browser, and it’ll take you to Trezor’s homepage.

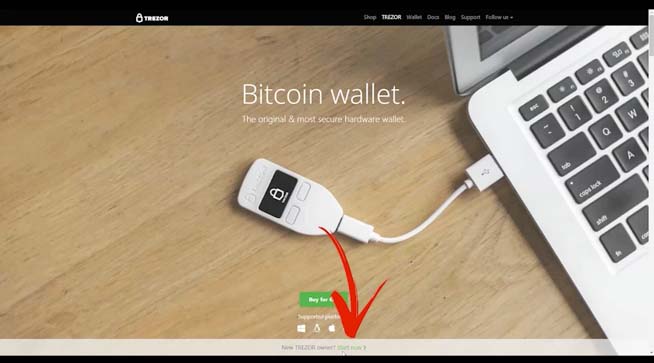

Okay, at the very bottom of the page…

I mean, the VERY bottom…

Click on “New Trezor Owner? Start Now.”

Okay, this screen provides you with a very self-explanatory set up process.

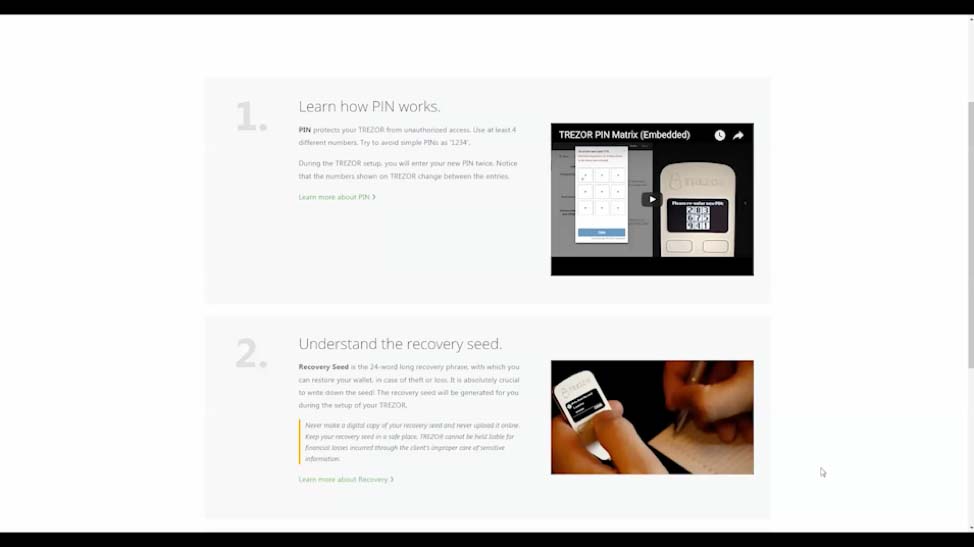

Before you begin the process, let me brief you on what’s about to happen….

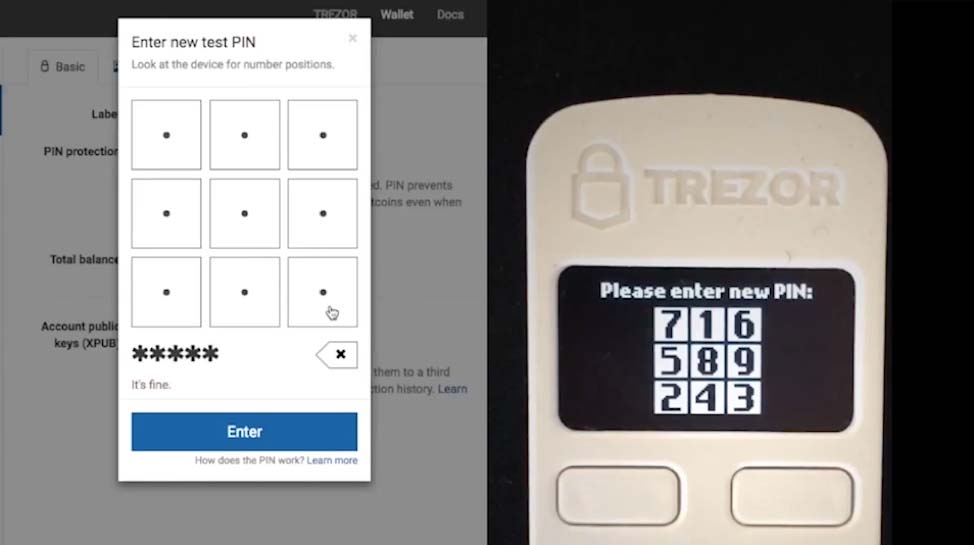

Step #1 will require you to set a pin number.

Step #2 will require you to set what Trezor calls a “recovery seed.”

You’ll only need the recovery seed if you lose your device.

Oh, and you’ll need a pen and paper for step #2.

As you’re about to see, step #2 requires you to write down 24 short words.

I know, I know…

This is unlike anything you’ve ever done before.

But I warned you at the start….

The Trezor device is for folks who want the feeling of a physical padlock on their digital wallet.

As you’re completing steps #1 and #2, please store your pin number and the 24 “seed” words in a safe place.

Oh, one last thing before you get started…

Step #3 is optional.

If you choose to enter your email address, Trezor will hit your inbox with updates about the Wallet.

Step #3 is totally up to you.

Okay, this is a good time to plug your Trezor Wallet into a USB port and complete steps #1, #2… and even #3 if you want to get email updates.

Okay, you’re plugged in?

Good.

You’re probably noticing a prompt on your screen.

Go ahead and download the software — according to the operating system you’re using.

Then, you’ll get another prompt to verify the download.

Just click “Ok,” and navigate through the download process.

Perfect.

You’re so close now!

Click the “Wallet” header on the top navigation bar.

Doing so will officially begin the set-up process for the PIN number and the “recovery seed.”

I recommend pausing this video right now, setting your pin number and recovery seed.

Go ahead and pause the video now.

======

Welcome back!

Okay, please make sure you’re at the “wallet” page by clicking “wallet” on the top navigation bar.

The page automatically defaults to your Bitcoin dashboard.

From here, you can send and receive any amount of Bitcoin you have in your wallet.

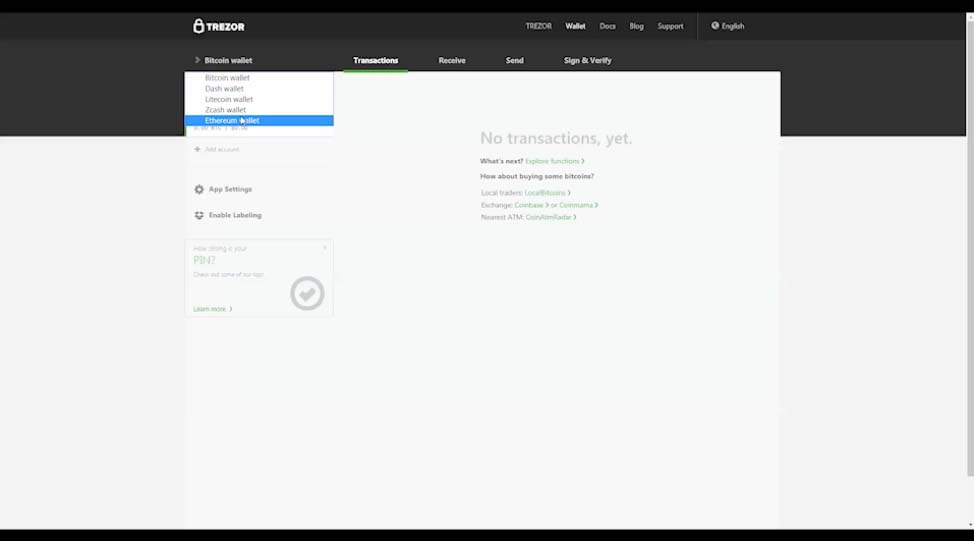

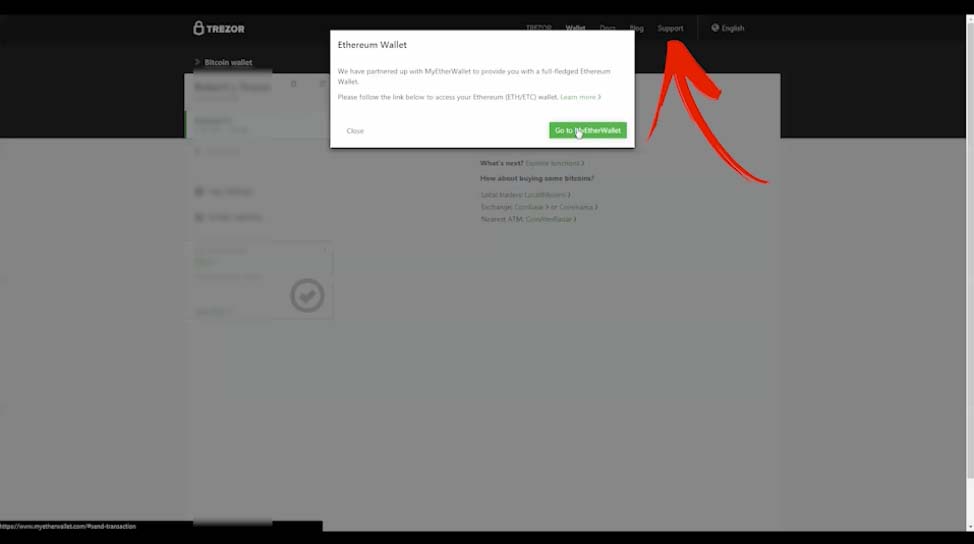

If you want to work with Ethereum instead, click on "Bitcoin Wallet,” and a drop down menu will appear. Then choose, “Ethereum.”

Then, simply follow the steps to set up an Ethereum wallet.

If you have any questions about your Trezor device, please click on the “Support” tab at the top navigation bar.

I’ve tested the support link, and it’s very dynamic with lots of great troubleshooting information.

Okay, in the next video, I’ll discuss my brand-new cryptocurrency recommendations.

This is Louis Basenese.

Over and out.

Active Recommendation: Monero.

Louis Basenese here, Director of Cryptocurrencies here at Agora Financial.

Welcome back.

Ok. The time has come for me to announce our top three cryptocurrency recommendations.

While we’ll be adding new cryptocurrencies to the portfolio all the time, these are the three we’ve isolated as the best picks for new subscribers.

Alright, let’s jump right in with the first crypto… Something I call the king of anonymity.

>>Crypto Trade #1: The King of Anonymity

A little background before I dig in…

Thirty years ago, we had two ways of keeping our financial affairs anonymous: you either held cash… or you put your money in Swiss bank accounts.

Now the Feds have made a treaty with Switzerland along with domestic legislation that have effectively ended the anonymity of Swiss bank accounts for Americans.

So what about cash? Well, central banks and academics are already speculating about the potential for a cashless society.

Fortunately, cryptocurrencies are able to provide an alternative avenue for people who value their financial privacy.

But even Bitcoin isn’t fully anonymous, since all transactions are stored on a public ledger.

That’s where Monero (XMR) comes in.

Monero is the world’s leading fully anonymous cryptocurrency.

Monero (XMR) has several privacy features which get it very close to full anonymity and in the worst case make creating decisive (rather than circumstantial) evidence in a court case nearly impossible.

Without getting overly complicated, Monero boasts a sort of stealth cryptography that masks the sending address, amount and receiving address for each transaction.

Think of Monero’s ledger as an opaque blockchain.

This diagram shows how a Monero transaction achieves anonymity. Even if you found the receiving address of a Monero transaction, you still wouldn’t be able to determine if the sending address was A, B or C. It does provide a way for users to disclose transaction details, but the feature must be manually enabled.

Better yet, Monero does plan to take this one step further, as well. An imminent upgrade - with a technology called the Kovri router - will allow Monero to conceal the IP addresses of its users as well. Completing the anonymity puzzle.

This has potentially huge advantages for ordinary people wishing to assure themselves of complete financial privacy in an era when Swiss bank accounts (and eventually cash) are no longer available means to do this.

What’s more, Monero also has a better algorithm than its competitors. While most cryptocurrencies are designed to be mined using computer graphics cards, Monero mining relies on a computer’s processor power.

This makes it more accessible for consumers with ordinary computers.

It’s interesting to note that even Monero’s launch was stealthy…

Monero had no Initial Coin Offering. It also had no pre-mining where developers could mine it before release. It is an open-source project with seven designers, only two of whom are known.

That makes it especially attractive to the cryptocurrency community because it remains open-source with no corporation behind it.

Overall, Monero’s ambition is to replace Bitcoin as the leading all-purpose cryptocurrency, through its better algorithm and more secure anonymity.

Monero has a market capitalization of about $520 million, with a total liquid supply of 14.8 million units of XMR. It has an initial potential supply of 18.4 million XMR, which is expected to be attained in May 2022.

For specific buy instructions, including recommended buy-up-to prices, refer to this link.

In video #8, I’ll reveal our second crypto recommendation.

Action: Buy Monero (XMR) over the Bittrex Exchange using your Bitcoin wallet at no more than 0.017BTC ($40.00)

Active Recommendation: Golem.

Louis Basenese here, Director of Cryptocurrencies here at Agora Financial.

Welcome back.

Let’s dive right in and get to the next cryptocurrency recommendation on our list.

And we chose this next crypto because - unlike hundreds of other cryptocurrencies out there - this one isn’t built on hype.

Sure, boasting strong sponsors and a good marketing campaign certainly help gain traction for a new currency. But the most important factor is the nature of the cryptocurrency itself.

That is, how well it is engineered — along with other factors that give the currency real, sustainable value.

By doing so, it can continue to build momentum into the future, rather than fall victim to a short-term bubble effect...

And the next crypto fits that description perfectly. I call it The Ground-Floor Superstar.

>>Crypto Trade #2: The Ground-Floor Superstar

It’s called Golem (GNT). And this cryptocurrency isn’t just build on a solid platform. It’s the backbone of an actual tech business.

More specifically, it’s at the heart of a dispersed P2P “cloud” supercomputing network.

According to Forbes, you can think of this system as an Airbnb for computers. If you install the Golem software, a virtual computing environment is created in the background of your computer.

Then someone with a heavy software need, for example an animator trying to render his animated film project, can pay the network in Golem units to have his project rendered.

The animator’s task is downloaded onto your computer in the background, and sent back to the animator when it is completed. You receive a payment in GNT for carrying out a portion of the animator’s task. There is no “mining” like what’s used to generate new Bitcoins. New Golem units will be generated by successful completion of projects.

GNT is being developed by the Golem Network, which is controlled by Golem Factory GmbH, of Zug, Switzerland. But its operations are based in Poland, which has become a major high-tech hub, particularly in software. In fact, Poland has a competititve advantage in this business. Since it boasts a large universe of highly skilled people combined with relatively low labor costs — compared with Silicon Valley.

Now, the Golem Network has determined that the best initial market for its cloud supercomputing network is the makers of animated films and 3D models. Data requirements for these companies are huge and very complex. So they certainly benefit from the distributed capabilities of a large computer network.

The problem is, the options available to them currently come with a high cost. So the Golem Network should be highly competitive on price.

When it’s completed, that is.

You see, the Golem Network project is currently in alpha testing, with “proof of concept” for the 3D animator market, the project's main initial market, due out in the next few months. Once the alpha testing has been completed, a more robust product for the animator market will be developed, followed by spin-offs for other markets.

So think of Golem as a venture capital investment. You’re getting in on the ground floor of a crypto that’s destined to blast to the moon — once the project is in full operation.

Few cryptocurrencies are at the center of a genuine business with major growth potential in the real world, as is GNT.

With such a solid real-world basis for the crypto’s value, it’s likely to continue building momentum for years to come.

Golem’s Initial Coin Offering was in November 2016. As I record this, Golem has a market capitalization of about $217 million, with a total liquid supply of 833 million GNT. (There is 1 billion in total supply, but the remainder is reserved for the Zug company and the developers.)

For specific buy instructions, including recommended buy-up-to prices, refer to this link.

In video #9, I’ll reveal our third crypto recommendation to add to your portfolio.

Action: Buy Golem (GNT) over the Bittrex Exchange using your Bitcoin wallet at no more than 0.00015BTC ($0.35)

Active Recommendation: Komodo.

Louis Basenese here, Director of Cryptocurrencies here at Agora Financial.

Welcome back.

It’s time to reveal our third cryptocurrency play.

Now, when Bitcoin was founded in 2009, it used an entirely new technology - the blockchain - to solve the problem of decentralizing transactions.

But new developments are taking cryptocurrency technology to the next level.

Developers are pushing the limits and diving into new frontiers to achieve additional value.

That’s where the next recommendation comes in, which I call the revolutionary.

>>Crypto Trade #3: The Revolutionary

Komodo (KMD) is a relatively new coin, but it’s a technological leader among cryptocurrencies.

Yet the algorithm used by Komodo is based on an older, larger coin, called ZCash.

ZCash’s algorithm was developed by researchers at Johns Hopkins University, MIT and the Israeli universities Technicon and Tel Aviv. It offers a higher level of anonymity than Bitcoin’s blockchain.

ZCash was then supported by venture capitalists, banks and government bodies, and has grown to around the 15th largest cryptocurrency, with around $343 million in market capitalization.

The problem with ZCash is that the cryptocurrency market is all about decentralization. So there’s little market demand for a government-supported crypto.

Komodo was therefore developed to use the ZCash algorithm — minus ZCash’s government ties.

Komodo’s developers are top notch, move fast, and have prior experience building currencies. The lead developer, for instance, had previously created BitcoinDark — which boasts extra layers of anonymity.

So it’s not surprising that they’ve armed Komodo with 4 killer features.

- Mining Komodo transactions involves a Delayed Proof of Work algorithm, which notarizes transactions on both the Komodo and Bitcoin blockchains, meaning that a malicious hacker would have to compromise both the Bitcoin and Komodo blockchains to subvert Komodo’s integrity. Komodo also offers this service to third party coins.

- Komodo has a decentralized exchange mechanism for cryptocurrencies called EasyDEX, which allows holders to exchange cryptocurrencies directly, without trusting third parties. This reduces the risk of exchange failure, a significant hazard to investors in the cryptocurrency world.

- Komodo is working to enable smart contracts, where transactions can be programmable - like on the Ethereum platform. This may enable other cryptocurrencies to launch from Komodo’s platform.

- Komodo has created a decentralized asset exchange, allowing users to trade for tokens that are pegged to existing regular currencies – like e-dollars, e-euro, etc.

By creating these additional features, the developers will attract more users to the Komodo platform, thereby increasing its market capitalization and coin price.

The competition between cryptocurrencies is likely to depend heavily on the quality and features of the technology underlying each currency’s operations. In this respect, Komodo appears to be superior.

Komodo currently is a fairly new and relatively small coin, with incredible features and a dedicated community. And it’s not being heavily hyped yet on online message boards. At least not yet!

Add it all up, and Komodo is undervalued relative to other cryptocurrencies, and has an excellent chance of achieving a more prominent place in the market, with a corresponding rise in its price.

Komodo was founded through an Initial Coin Offering in October and November 2016.

As I film this, it sports a market capitalization of about $96 million, with a total liquid supply of 100.9 million KMD units.

For specific buy instructions, including recommended buy-up-to prices, refer to this link.

Well, that concludes our 9-part video series for The Crypto Alert. If you have any questions, please don’t hesitate to call our customer solutions team at 1-800-708-1020 — anytime Monday through Friday, 9-5 eastern time.

For The Crypto Alert, this is Louis Basenese signing off.

Action: Buy Komodo (KMD) over the Bittrex Exchange using your Bitcoin wallet at no more than 0.00040BTC ($1.10)

Bonus Video: An Imminent Initial Coin Offering (ICO)

Louis Basenese here, Director of Cryptocurrencies at Agora Financial.

You've now seen three of our favorite, red-hot cryptocurrency recommendations.

So now, let's review another area we plan to cover regularly at The Crypto Alert, that is upcoming cryptocurrency launches through Initial Coin Offerings, or ICOs.

The ICO we're tracking right now is called Chronologic.

Chronologic is the first cryptocurrency whose value is based on time rather than on the conventional mining solution of mathematical problems.

Chronologic was developed by a team led by a former Goldman Sachs venture capitalist. It's value rests on the thesis that time is central to the great majority of contracts in the financial and business world.

The developers of Chronologic hope that it will become the basis for a series of time-based cryptocurrencies, on which a wide variety of bond, derivatives and other contracts will be based.

By using its time-based cryptocurrency technology to develop applications in the real world, Chronologic's tokens will increase in value and market share.

Now we'll go more in depth on what that exactly means in the real world in future alerts. But here's what we know about this fast approaching ICO...

The Initial Coin Offering for Chronologic will begin on August 28th, with the sale of time mints, which will manufacture day tokens.

These are expected to be listed on an exchange such as Bittrex.

I promise, we will inform you immediately once a listing is granted.

Now the total number of day tokens issued in the ICO will be capped at 38,383 Etherium units. So about $9.5 million at today's Etherium price.

US investors will not be eligible to buy time mints, so we propose to buy day tokens over an exchange when they are listed, with a firm limit price to avoid chasing the price of an initially very limited supply.

Again, expect more details in an upcoming alert as we get closer to the ICO date.

This is Louis Basenese, signing off.